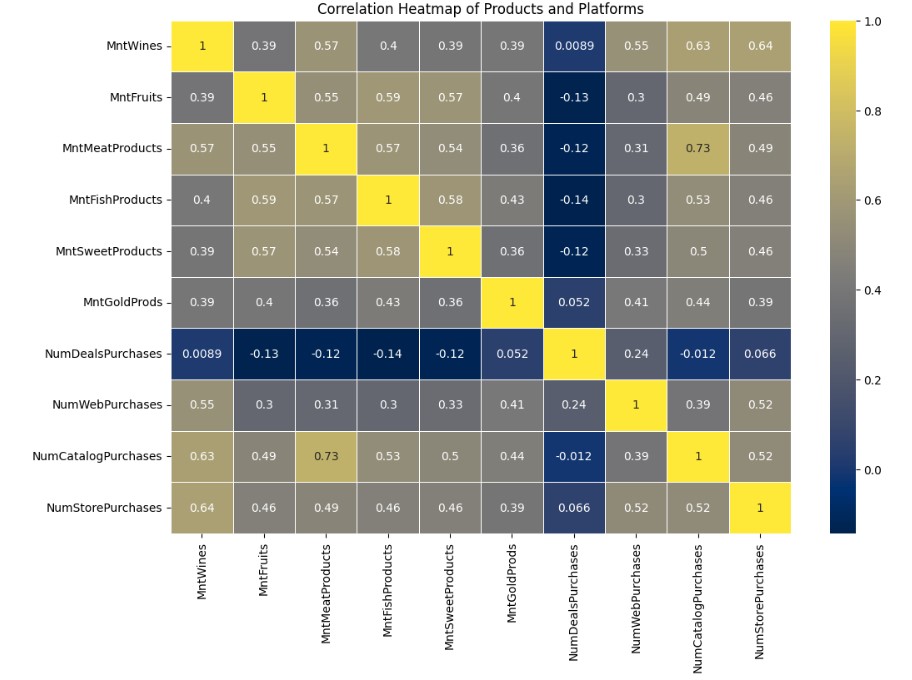

Product and Purchase Platform Breakdown

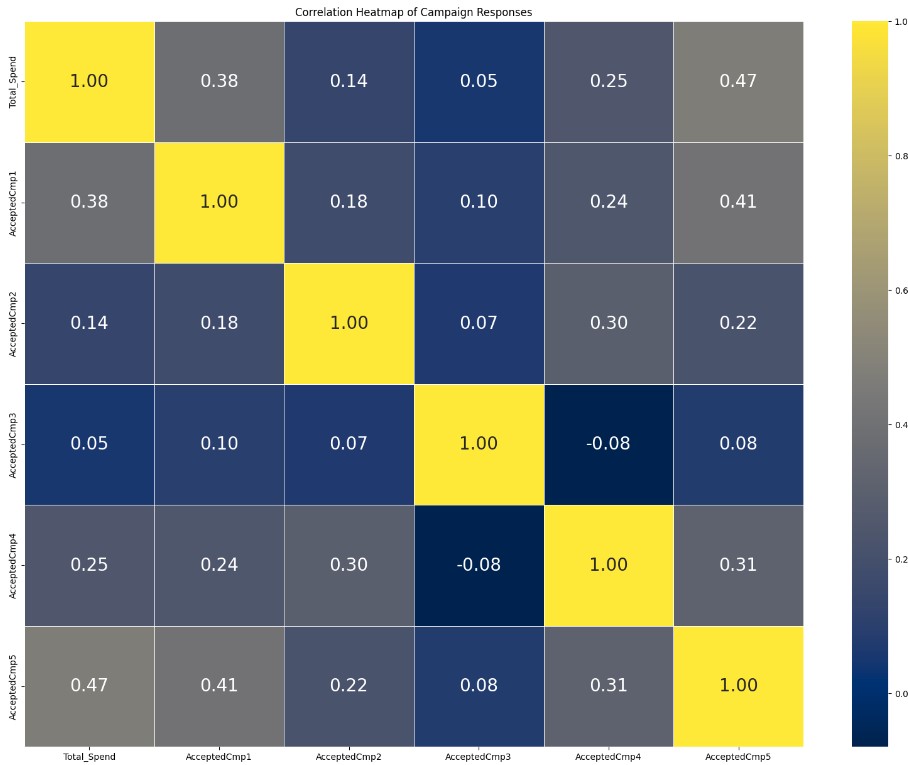

In order to understand any correlation between each of the products purchased, as well as the platform in which they were purchased, I created a heatmap in Python.

There are not necessarily strong correlations but the ones that jump out are: 1) the correlation between meat and wine - as previously noticed, these are popular items, 2) the correlation between fish/sweets and fruit,

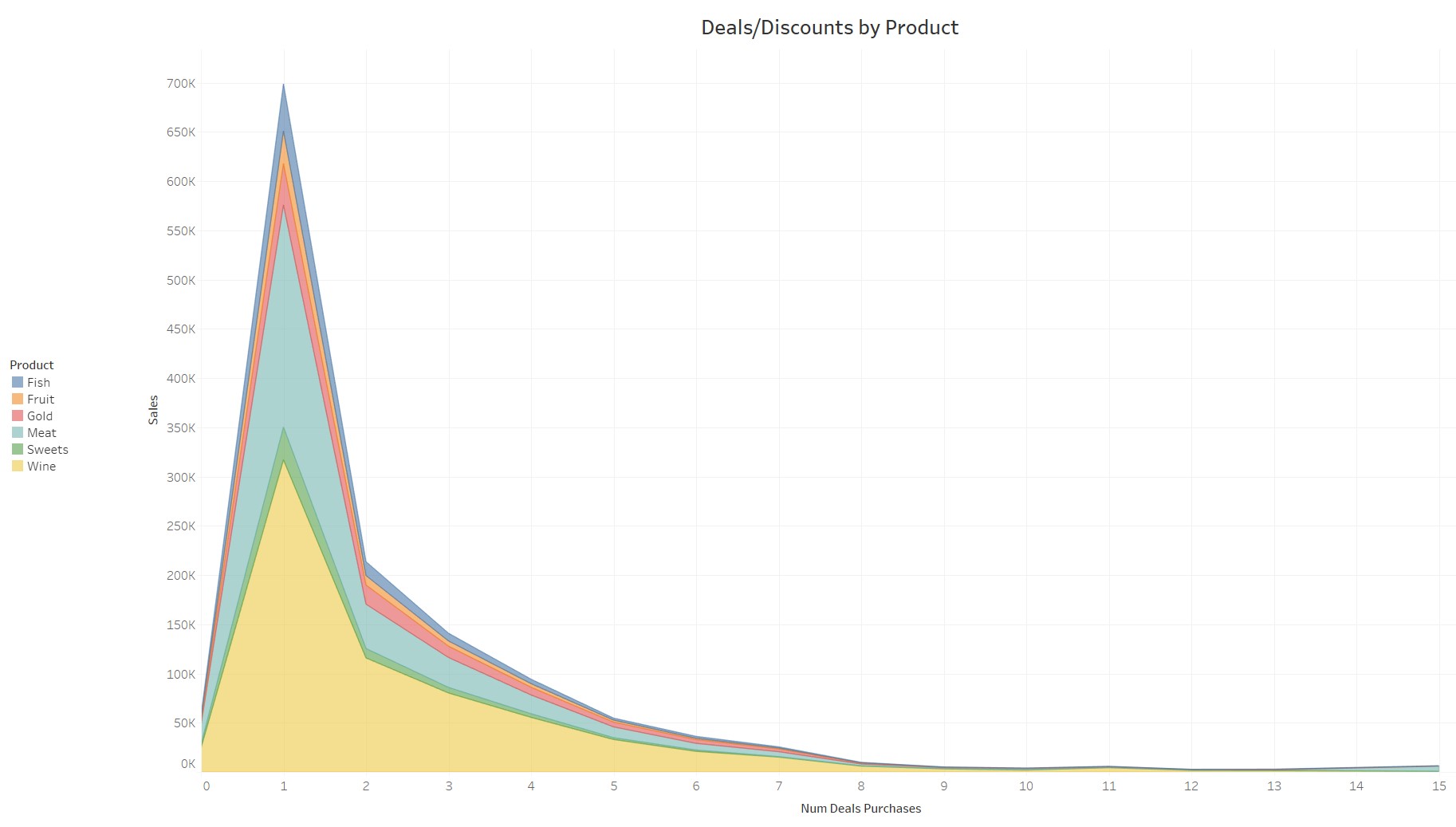

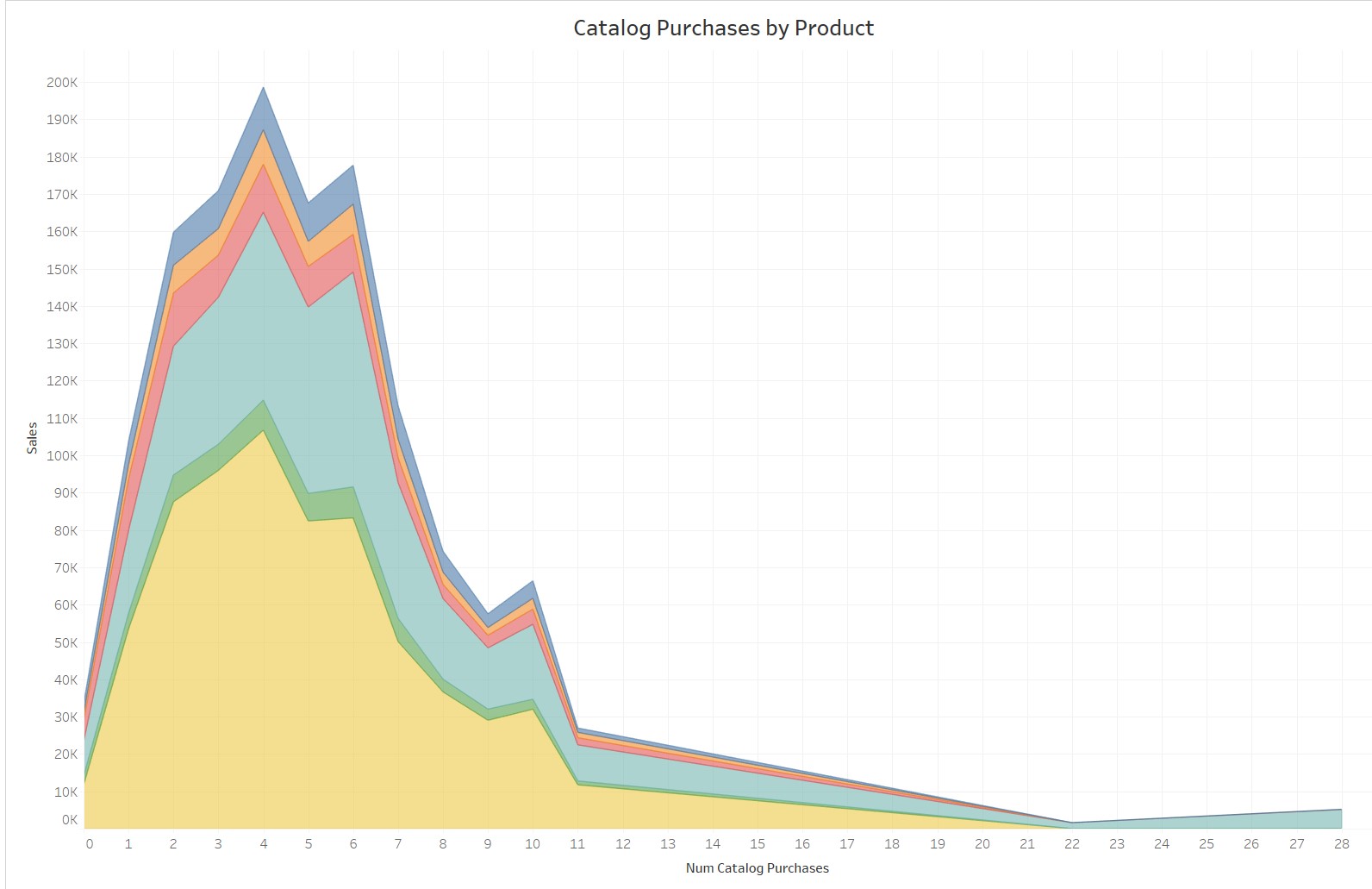

and 3) the meat purchases attributed to purchasing via catalog. There appears to be a very weak correlation between the "deals" (aka discounts) purchases for each of the products.

This proves the store could do a better job offering coupons and discounts to drive in more customers.

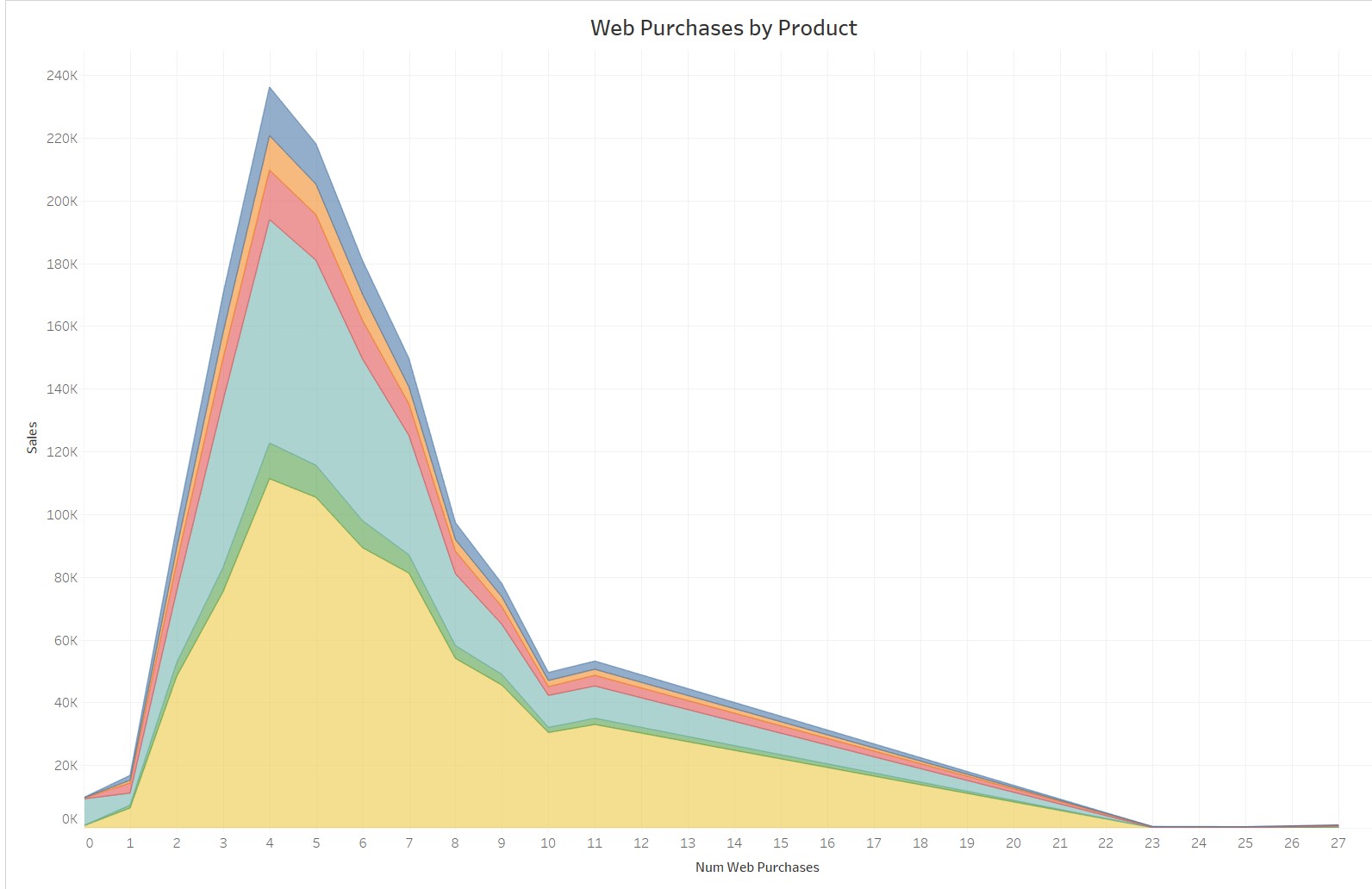

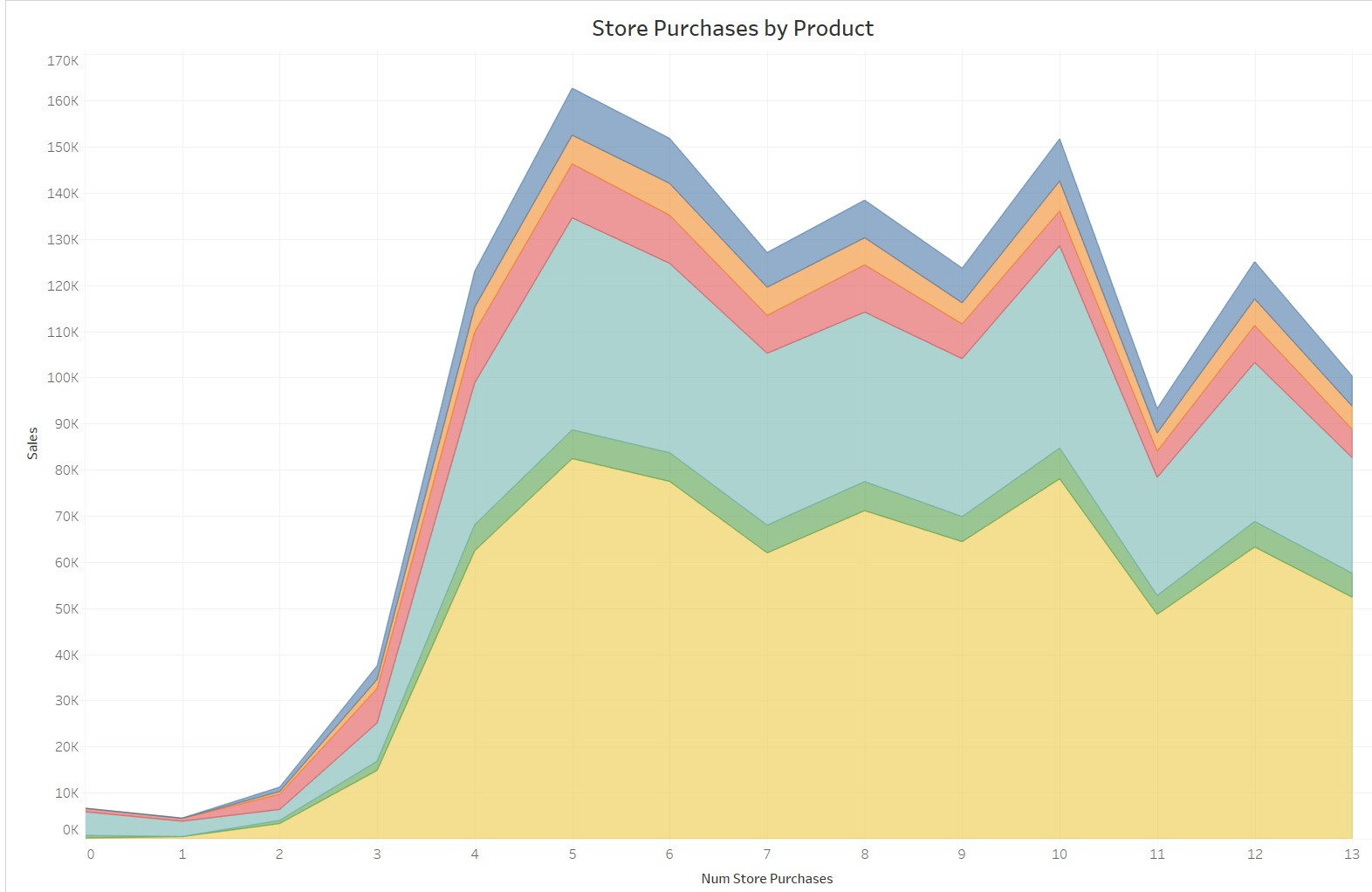

Below are the four graphs that represent products purchased with a discount, via web, via catalog, and via in-store.

Because the first three graphs show a sharp decline over time, the store should work to promote products via these avenues for consistency. Web and catalog could increase due to a revised interface or online-exclusive coupons.